Page 14 - MONECO Financial Training Catalogue

P. 14

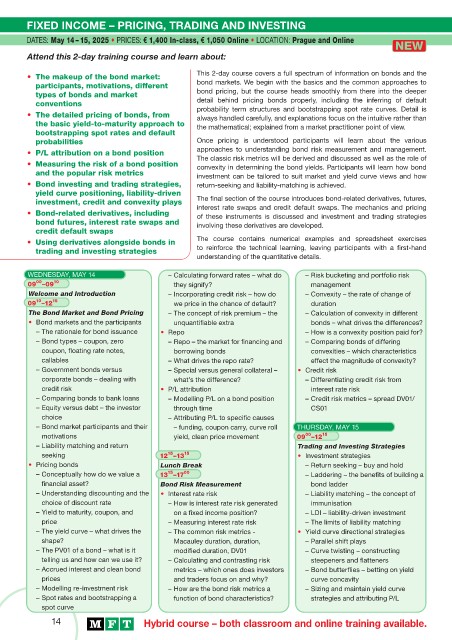

FIXED INCOME – PRICING, TRADING AND INVESTING

DATES: May 14 – 15, 2025 • PRICES: € 1,400 In-class, € 1,050 Online • LOCATION: Prague and Online

Attend this 2-day training course and learn about:

• The makeup of the bond market: This 2-day course covers a full spectrum of information on bonds and the

participants, motivations, different bond markets. We begin with the basics and the common approaches to

types of bonds and market bond pricing, but the course heads smoothly from there into the deeper

conventions detail behind pricing bonds properly, including the inferring of default

probability term structures and bootstrapping spot rate curves. Detail is

• The detailed pricing of bonds, from always handled carefully, and explanations focus on the intuitive rather than

the basic yield-to-maturity approach to the mathematical; explained from a market practitioner point of view.

bootstrapping spot rates and default

probabilities Once pricing is understood participants will learn about the various

• P/L attribution on a bond position approaches to understanding bond risk measurement and management.

The classic risk metrics will be derived and discussed as well as the role of

• Measuring the risk of a bond position convexity in determining the bond yields. Participants will learn how bond

and the popular risk metrics

investment can be tailored to suit market and yield curve views and how

• Bond investing and trading strategies, return-seeking and liability-matching is achieved.

yield curve positioning, liability-driven

investment, credit and convexity plays The fi nal section of the course introduces bond-related derivatives, futures,

interest rate swaps and credit default swaps. The mechanics and pricing

• Bond-related derivatives, including of these instruments is discussed and investment and trading strategies

bond futures, interest rate swaps and

credit default swaps involving these derivatives are developed.

• Using derivatives alongside bonds in The course contains numerical examples and spreadsheet exercises

trading and investing strategies to reinforce the technical learning, leaving participants with a fi rst-hand

understanding of the quantitative details.

WEDNESDAY, MAY 14 – Calculating forward rates – what do – Risk bucketing and portfolio risk

00

09 – 09 10 they signify? management

Welcome and Introduction – Incorporating credit risk – how do – Convexity – the rate of change of

10

09 –12 15 we price in the chance of default? duration

The Bond Market and Bond Pricing – The concept of risk premium – the – Calculation of convexity in different

• Bond markets and the participants unquantifi able extra bonds – what drives the differences?

– The rationale for bond issuance • Repo – How is a convexity position paid for?

– Bond types – coupon, zero – Repo – the market for fi nancing and – Comparing bonds of differing

coupon, fl oating rate notes, borrowing bonds convexities – which characteristics

callables – What drives the repo rate? effect the magnitude of convexity?

– Government bonds versus – Special versus general collateral – • Credit risk

corporate bonds – dealing with what’s the difference? – Differentiating credit risk from

credit risk • P/L attribution interest rate risk

– Comparing bonds to bank loans – Modelling P/L on a bond position – Credit risk metrics – spread DV01/

– Equity versus debt – the investor through time CS01

choice – Attributing P/L to specifi c causes

– Bond market participants and their – funding, coupon carry, curve roll THURSDAY, MAY 15

00

motivations yield, clean price movement 09 –12 15

– Liability matching and return Trading and Investing Strategies

15

seeking 12 –13 15 • Investment strategies

• Pricing bonds Lunch Break – Return seeking – buy and hold

15

– Conceptually how do we value a 13 –17 00 – Laddering – the benefi ts of building a

fi nancial asset? Bond Risk Measurement bond ladder

– Understanding discounting and the • Interest rate risk – Liability matching – the concept of

choice of discount rate – How is interest rate risk generated immunisation

– Yield to maturity, coupon, and on a fi xed income position? – LDI – liability-driven investment

price – Measuring interest rate risk – The limits of liability matching

– The yield curve – what drives the – The common risk metrics - • Yield curve directional strategies

shape? Macauley duration, duration, – Parallel shift plays

– The PV01 of a bond – what is it modifi ed duration, DV01 – Curve twisting – constructing

telling us and how can we use it? – Calculating and contrasting risk steepeners and fl atteners

– Accrued interest and clean bond metrics – which ones does investors – Bond butterfl ies – betting on yield

prices and traders focus on and why? curve concavity

– Modelling re-investment risk – How are the bond risk metrics a – Sizing and maintain yield curve

– Spot rates and bootstrapping a function of bond characteristics? strategies and attributing P/L

spot curve

14 Hybrid course – both classroom and online training available.