Page 9 - MONECO Financial Training Catalogue

P. 9

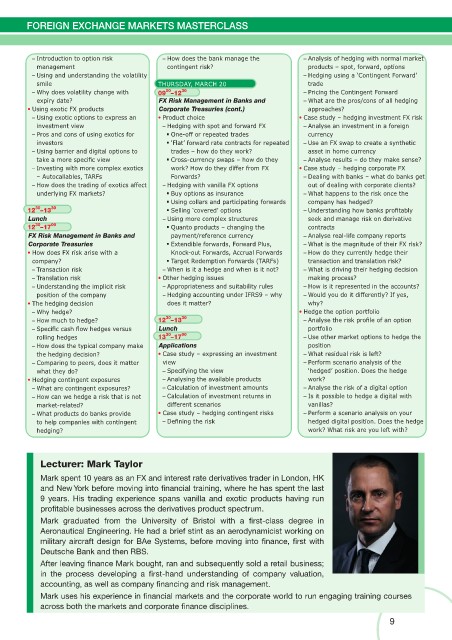

FOREIGN EXCHANGE MARKETS MASTERCLASS

– Introduction to option risk – How does the bank manage the – Analysis of hedging with normal market

management contingent risk? products – spot, forward, options

– Using and understanding the volatility – Hedging using a ‘Contingent Forward’

smile THURSDAY, MARCH 20 trade

00

– Why does volatility change with 09 –12 30 – Pricing the Contingent Forward

expiry date? FX Risk Management in Banks and – What are the pros/cons of all hedging

• Using exotic FX products Corporate Treasuries (cont.) approaches?

– Using exotic options to express an • Product choice • Case study – hedging investment FX risk

investment view – Hedging with spot and forward FX – Analyse an investment in a foreign

– Pros and cons of using exotics for One-off or repeated trades currency

investors ‘Flat’ forward rate contracts for repeated – Use an FX swap to create a synthetic

– Using barrier and digital options to trades – how do they work? asset in home currency

take a more specifi c view Cross-currency swaps – how do they – Analyse results – do they make sense?

– Investing with more complex exotics work? How do they diff er from FX • Case study – hedging corporate FX

– Autocallables, TARFs Forwards? – Dealing with banks – what do banks get

– How does the trading of exotics aff ect – Hedging with vanilla FX options out of dealing with corporate clients?

underlying FX markets? Buy options as insurance – What happens to the risk once the

Using collars and participating forwards company has hedged?

30

12 –13 30 Selling ‘covered’ options – Understanding how banks profi tably

Lunch – Using more complex structures seek and manage risk on derivative

00

30

12 –17 Quanto products – changing the contracts

FX Risk Management in Banks and payment/reference currency – Analyse real-life company reports

Corporate Treasuries Extendible forwards, Forward Plus, – What is the magnitude of their FX risk?

• How does FX risk arise with a Knock-out Forwards, Accrual Forwards – How do they currently hedge their

company? Target Redemption Forwards (TARFs) transaction and translation risk?

– Transaction risk – When is it a hedge and when is it not? – What is driving their hedging decision

– Translation risk • Other hedging issues making process?

– Understanding the implicit risk – Appropriateness and suitability rules – How is it represented in the accounts?

position of the company – Hedging accounting under IFRS9 – why – Would you do it diff erently? If yes,

• The hedging decision does it matter? why?

– Why hedge? • Hedge the option portfolio

30

– How much to hedge? 12 –13 30 – Analyse the risk profi le of an option

– Specifi c cash fl ow hedges versus Lunch portfolio

30

rolling hedges 13 –17 00 – Use other market options to hedge the

– How does the typical company make Applications position

the hedging decision? • Case study – expressing an investment – What residual risk is left?

– Comparing to peers, does it matter view – Perform scenario analysis of the

what they do? – Specifying the view ‘hedged’ position. Does the hedge

• Hedging contingent exposures – Analysing the available products work?

– What are contingent exposures? – Calculation of investment amounts – Analyse the risk of a digital option

– How can we hedge a risk that is not – Calculation of investment returns in – Is it possible to hedge a digital with

market-related? diff erent scenarios vanillas?

– What products do banks provide • Case study – hedging contingent risks – Perform a scenario analysis on your

to help companies with contingent – Defi ning the risk hedged digital position. Does the hedge

hedging? work? What risk are you left with?

Lecturer: Mark Taylor

Mark spent 10 years as an FX and interest rate derivatives trader in London, HK

and New York before moving into fi nancial training, where he has spent the last

9 years. His trading experience spans vanilla and exotic products having run

profi table businesses across the derivatives product spectrum.

Mark graduated from the University of Bristol with a fi rst-class degree in

Aeronautical Engineering. He had a brief stint as an aerodynamicist working on

military aircraft design for BAe Systems, before moving into fi nance, fi rst with

Deutsche Bank and then RBS.

After leaving fi nance Mark bought, ran and subsequently sold a retail business;

in the process developing a fi rst-hand understanding of company valuation,

accounting, as well as company fi nancing and risk management.

Mark uses his experience in fi nancial markets and the corporate world to run engaging training courses

across both the markets and corporate fi nance disciplines.

9