Page 10 - MONECO Financial Training Catalogue

P. 10

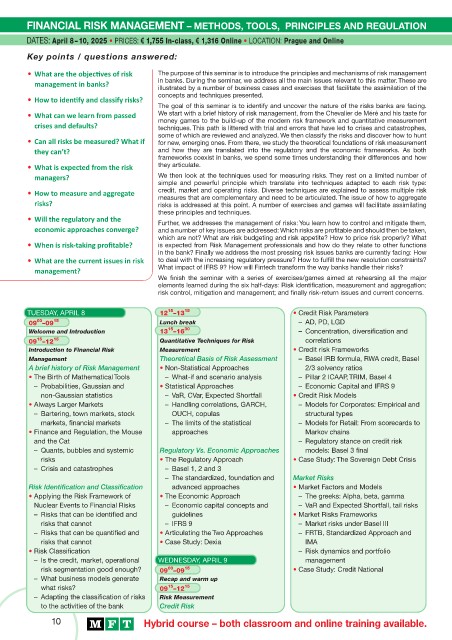

FINANCIAL RISK MANAGEMENT – METHODS, TOOLS, PRINCIPLES AND REGULATION

DATES: April 8 – 10, 2025 • PRICES: € 1,755 In-class, € 1,316 Online • LOCATION: Prague and Online

Key points / questions answered:

• What are the objecƟ ves of risk The purpose of this seminar is to introduce the principles and mechanisms of risk management

management in banks? in banks. During the seminar, we address all the main issues relevant to this matter. These are

illustrated by a number of business cases and exercises that facilitate the assimilation of the

concepts and techniques presented.

• How to idenƟ fy and classify risks?

The goal of this seminar is to identify and uncover the nature of the risks banks are facing.

• What can we learn from passed We start with a brief history of risk management, from the Chevalier de Méré and his taste for

money games to the build-up of the modern risk framework and quantitative measurement

crises and defaults? techniques. This path is littered with trial and errors that have led to crises and catastrophes,

some of which are reviewed and analyzed. We then classify the risks and discover how to hunt

• Can all risks be measured? What if for new, emerging ones. From there, we study the theoretical foundations of risk measurement

they can’t? and how they are translated into the regulatory and the economic frameworks. As both

frameworks coexist in banks, we spend some times understanding their differences and how

• What is expected from the risk they articulate.

managers? We then look at the techniques used for measuring risks. They rest on a limited number of

simple and powerful principle which translate into techniques adapted to each risk type:

• How to measure and aggregate credit, market and operating risks. Diverse techniques are explained to assess multiple risk

measures that are complementary and need to be articulated. The issue of how to aggregate

risks? risks is addressed at this point. A number of exercises and games will facilitate assimilating

these principles and techniques.

• Will the regulatory and the

Further, we addresses the management of risks: You learn how to control and mitigate them,

economic approaches converge? and a number of key issues are addressed: Which risks are profi table and should then be taken,

which are not? What are risk budgeting and risk appetite? How to price risk properly? What

• When is risk-taking profi table? is expected from Risk Management professionals and how do they relate to other functions

in the bank? Finally we address the most pressing risk issues banks are currently facing: How

• What are the current issues in risk to deal with the increasing regulatory pressure? How to fulfi ll the new resolution constraints?

What impact of IFRS 9? How will Fintech transform the way banks handle their risks?

management?

We fi nish the seminar with a series of exercises/games aimed at rehearsing all the major

elements learned during the six half-days: Risk identifi cation, measurement and aggregation;

risk control, mitigation and management; and fi nally risk-return issues and current concerns.

15

TUESDAY, APRIL 8 12 –13 15 • Credit Risk Parameters

00

09 –09 15 Lunch break – AD, PD, LGD

15

Welcome and Introduction 13 –16 30 – Concentration, diversifi cation and

15

09 –12 15 Quantitative Techniques for Risk correlations

Introduction to Financial Risk Measurement • Credit risk Frameworks

Management Theoretical Basis of Risk Assessment – Basel IRB formula, RWA credit, Basel

A brief history of Risk Management • Non-Statistical Approaches 2/3 solvency ratios

• The Birth of Mathematical Tools – What-if and scenario analysis – Pillar 2 ICAAP, TRIM, Basel 4

– Probabilities, Gaussian and • Statistical Approaches – Economic Capital and IFRS 9

non-Gaussian statistics – VaR, CVar, Expected Shortfall • Credit Risk Models

• Always Larger Markets – Handling correlations, GARCH, – Models for Corporates: Empirical and

– Bartering, town markets, stock OUCH, copulas structural types

markets, fi nancial markets – The limits of the statistical – Models for Retail: From scorecards to

• Finance and Regulation, the Mouse approaches Markov chains

and the Cat – Regulatory stance on credit risk

– Quants, bubbles and systemic Regulatory Vs. Economic Approaches models: Basel 3 fi nal

risks • The Regulatory Approach • Case Study: The Sovereign Debt Crisis

– Crisis and catastrophes – Basel 1, 2 and 3

– The standardized, foundation and Market Risks

Risk Identifi cation and Classifi cation advanced approaches • Market Factors and Models

• Applying the Risk Framework of • The Economic Approach – The greeks: Alpha, beta, gamma

Nuclear Events to Financial Risks – Economic capital concepts and – VaR and Expected Shortfall, tail risks

– Risks that can be identifi ed and guidelines • Market Risks Frameworks

risks that cannot – IFRS 9 – Market risks under Basel III

– Risks that can be quantifi ed and • Articulating the Two Approaches – FRTB, Standardized Approach and

risks that cannot • Case Study: Dexia IMA

• Risk Classifi cation – Risk dynamics and portfolio

– Is the credit, market, operational WEDNESDAY, APRIL 9 management

15

00

risk segmentation good enough? 09 –09 • Case Study: Credit National

– What business models generate Recap and warm up

15

what risks? 09 –12 15

– Adapting the classifi cation of risks Risk Measurement

to the activities of the bank Credit Risk

10 Hybrid course – both classroom and online training available.