Page 19 - MONECO Financial Training Catalogue

P. 19

BANK CAPITAL MANAGEMENT – ECONOMIC CAPITAL, FUNDS TRANSFER PRICING AND RAROC

• Organization of the Economic Capital • Organization of the ALM, the nuclear • Discussion of macro-prudential

team reactor of the bank regulation issues

– Required functions, committees • Commercial and Financial margins – Can bank still measure their risk

and IT support • Steering of the Commercial margin properly?

• Benchmarks and review of banks • Steering of the Financial margin – What impact of the banking regulation

disclosures • Pricing internal funding using on the economy?

Reference refi nancing – Moral hazard and the future of

Case study: Dexia regulation

15

• The rise and the fall: facts and 12 –13 15

fi gures Lunch break Final Game and Termination of the

15

• Analysis and lessons 13 –16 30 Seminar

Session Six

THURSDAY, NOVEMBER 6 RAROC, Macro-prudential Regulation

Session Five • RAROC

00

09 –09 45 – Different types of Risk Adjusted

Economic Capital Exercise Review measurement

and Discussion – Analysis of RAROC components

00

10 –12 15 – Live exercise

Funds Transfer Pricing

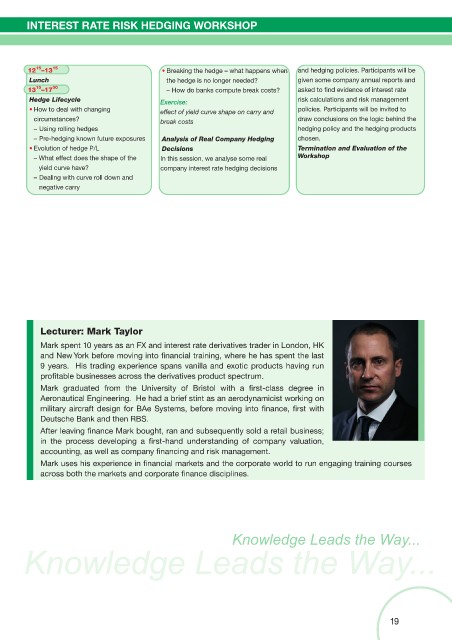

Lecturer: Jean-Bernard Caen

As a Policy Advisor within the consulting fi rm PRNS ‘parnass’ since 2014,

Jean-Bernard has been working on assignments for Financial Institutions in the

areas of risk-fi nance interactions, ALM, capital allocation, risk appetite and the

economic assessment of risks.

Before that, as Head of Economic Capital and Strategy for Dexia group for 12

years, he was in charge of Basel2 Pillar2 and Risk-Finance cooperation. He was

instrumental in working out and implementing Economic Capital as the internal

measure of risk. It was subsequently used in all risk vs. return processes across

the group, such as Risk Appetite, Risk Budgeting, RAROC and Capital Planning.

In 1990, Jean-Bernard founded the Management Consulting fi rm Finance &

Technology Management (FTM), which he ran for 12 years as the CEO. As such, he

directed numerous assignments for European Financial Institutions in the areas of

Shareholder Value, Risk Management, Capital Allocation and ALM.

He is a member of PRMIA France Executive Committee, of AFGAP Management Board, and he teaches

at the French National School of Economics and Statistics; he is also a senior lecturer and he published

numerous articles.

He is a French Civil Engineer and he graduated from MIT.

19