Page 16 - MONECO Financial Training Catalogue

P. 16

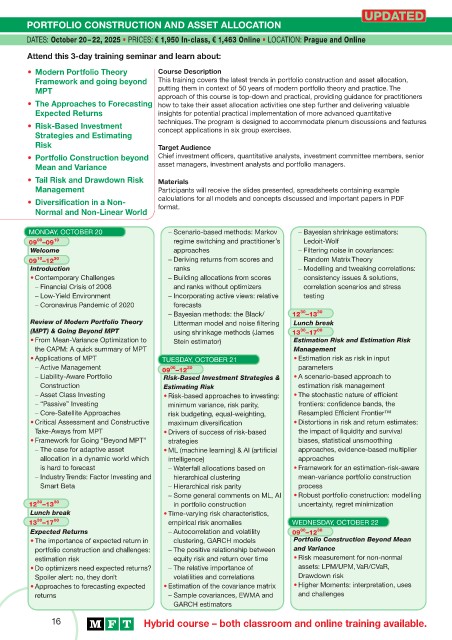

PORTFOLIO CONSTRUCTION AND ASSET ALLOCATION

DATES: October 20 – 22, 2025 • PRICES: € 1,950 In-class, € 1,463 Online • LOCATION: Prague and Online

Attend this 3-day training seminar and learn about:

• Modern Portfolio Theory Course Description

Framework and going beyond This training covers the latest trends in portfolio construction and asset allocation,

MPT putting them in context of 50 years of modern portfolio theory and practice. The

approach of this course is top-down and practical, providing guidance for practitioners

• The Approaches to Forecasting how to take their asset allocation activities one step further and delivering valuable

Expected Returns insights for potential practical implementation of more advanced quantitative

techniques. The program is designed to accommodate plenum discussions and features

• Risk-Based Investment

concept applications in six group exercises.

Strategies and Estimating

Risk Target Audience

• Portfolio Construction beyond Chief investment offi cers, quantitative analysts, investment committee members, senior

Mean and Variance asset managers, investment analysts and portfolio managers.

• Tail Risk and Drawdown Risk Materials

Management Participants will receive the slides presented, spreadsheets containing example

calculations for all models and concepts discussed and important papers in PDF

• Diversifi cation in a Non-

format.

Normal and Non-Linear World

MONDAY, OCTOBER 20 Scenario-based methods: Markov Bayesian shrinkage estimators:

00

09 –09 10 regime switching and practitioner’s Ledoit-Wolf

Welcome approaches Filtering noise in covariances:

10

09 –12 30 Deriving returns from scores and Random Matrix Theory

Introduction ranks Modelling and tweaking correlations:

• Contemporary Challenges Building allocations from scores consistency issues & solutions,

Financial Crisis of 2008 and ranks without optimizers correlation scenarios and stress

Low-Yield Environment Incorporating active views: relative testing

Coronavirus Pandemic of 2020 forecasts

30

Bayesian methods: the Black/ 12 –13 30

Review of Modern Portfolio Theory Litterman model and noise fi ltering Lunch break

(MPT) & Going Beyond MPT using shrinkage methods (James 13 –17 00

30

• From Mean-Variance Optimization to Stein estimator) Estimation Risk and Estimation Risk

the CAPM: A quick summary of MPT Management

• Applications of MPT TUESDAY, OCTOBER 21 • Estimation risk as risk in input

Active Management 09 –12 30 parameters

00

Liability-Aware Portfolio Risk-Based Investment Strategies & • A scenario-based approach to

Construction Estimating Risk estimation risk management

Asset Class Investing • Risk-based approaches to investing: • The stochastic nature of effi cient

“Passive” Investing minimum variance, risk parity, frontiers: confi dence bands, the

Core-Satellite Approaches risk budgeting, equal-weighting, Resampled Effi cient Frontier™

• Critical Assessment and Constructive maximum diversifi cation • Distortions in risk and return estimates:

Take-Aways from MPT • Drivers of success of risk-based the impact of liquidity and survival

• Framework for Going “Beyond MPT” strategies biases, statistical unsmoothing

The case for adaptive asset • ML (machine learning) & AI (artifi cial approaches, evidence-based multiplier

allocation in a dynamic world which intelligence) approaches

is hard to forecast Waterfall allocations based on • Framework for an estimation-risk-aware

Industry Trends: Factor Investing and hierarchical clustering mean-variance portfolio construction

Smart Beta Hierarchical risk parity process

Some general comments on ML, AI • Robust portfolio construction: modelling

30

30

12 –13 in portfolio construction uncertainty, regret minimization

Lunch break • Time-varying risk characteristics,

00

30

13 –17 empirical risk anomalies WEDNESDAY, OCTOBER 22

Expected Returns Autocorrelation and volatility 09 –12 30

00

• The importance of expected return in clustering, GARCH models Portfolio Construction Beyond Mean

portfolio construction and challenges: The positive relationship between and Variance

estimation risk equity risk and return over time • Risk measurement for non-normal

• Do optimizers need expected returns? The relative importance of assets: LPM/UPM, VaR/CVaR,

Spoiler alert: no, they don’t volatilities and correlations Drawdown risk

• Approaches to forecasting expected • Estimation of the covariance matrix • Higher Moments: interpretation, uses

returns Sample covariances, EWMA and and challenges

GARCH estimators

16 Hybrid course – both classroom and online training available.